Industry | AIQUINTA for Finance and Banking

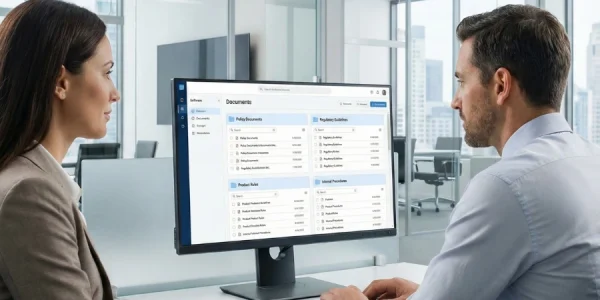

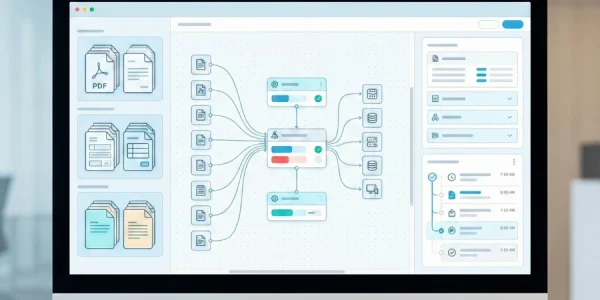

Turn financial documents into structured, decision-ready actions

Deploy AI agents that read documents, apply policies, and support decisions across onboarding, underwriting, and claims with full governance.

What's Damaging

Finance and Banking Organizations Performance?

Document-heavy and manual processes

Inconsistent decision-making

High operational and compliance risk

Business impact when these challenges are resolved

30–50% faster processing time

More consistent operations

Lower operational risk

Improved customer experience

Optimize Finance and Banking Operations

with AIQUINTA

See how AI agents can support claims processing, underwriting, compliance, and customer service.

Customer and Employee Identity Validation

Customer records, internal profiles, and policy documents are reviewed together to support identity validation workflows, enabling faster and more consistent verification across channels.

Internal Virtual Assistant

Answers employee questions from policies, procedures, and past cases, helping banks save 50–60% of staff time previously spent searching documents and escalating internal inquiries.

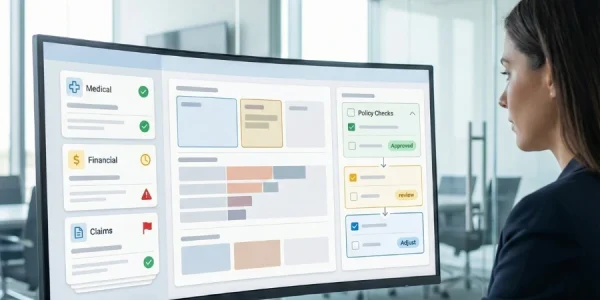

Credit and Risk Case Assessment

Loan and risk cases are assessed by synthesizing customer documents, historical decisions, and credit rules, improving consistency and reducing manual review effort across teams.

Regulatory and Compliance Document Handling

Regulatory texts, internal policies, and audit documents are consolidated to guide compliance checks, cutting 30–40% of compliance review time while improving audit readiness.

What makes AIQUINTA

the best solution

for

Finance and Banking Operations?

Knowledge-first approach

We structure and secure your manufacturing knowledge before deploying AI, ensuring accuracy and trust.

Built-in governance and control

Validation, approval workflows, and bounded execution support regulatory compliance.

Enterprise-grade security

Flexible deployment on-premise or cloud, with full data ownership and access control.

Designed for real operations

Built for document-heavy, process-driven environments, not generic chatbots.

that drive real business value